Something doesn’t add up. The Hunterdon County Commissioners want to sell the county dump — the Solid Waste Transfer Station on Petticoat Lane near Route 22 in Clinton Township — which has operated for over 30 years. (See Commissioners try to sell county dump: A garbage story.)

Something doesn’t add up. The Hunterdon County Commissioners want to sell the county dump — the Solid Waste Transfer Station on Petticoat Lane near Route 22 in Clinton Township — which has operated for over 30 years. (See Commissioners try to sell county dump: A garbage story.)

The dump is for municipal waste, and it’s where residents can dispose of solid waste including rubbish and recyclable materials. The dump gets heavy use. On weekends, residents and commercial users (e.g., building contractors) stack up along Petticoat Lane long before opening time. Users pay “tipping fees” to dump — also known as “revenue.”

For many years the dump was operated by a separate county body, the Hunterdon County Utilities Authority. In 2012 the freeholders dissolved the authority and took direct control of the dump. Local governments sometimes take over an independent authority — water, sewer, etc. — as a way to get their hands on revenue flows.

The dump generates $4,860,000 in annual revenue, according to the Proforma Operating Statement provided by Waste Management of NJ, Inc, which has been operating the dump under contract.

Questions about the dump sale based on statements made by county officials

It’s in documents exmayor.com obtained under the Sunshine Law, including the December 4, 2018 contract between the county and Waste Management of New Jersey, Inc. The commissioners have not publicly disclosed any of these facts.

- Waste Management, operator of the dump, reports estimated annual profits of $75,500 on $4,860,000 in revenues

- All operating costs are included in the contract and borne by WM.

- WM will pay monthly operating privilege fee to county of $1,666.67 in addition to $2.00/ton per month

- Estimated tons per day: 198.66

- Tipping fee for users: $81/ton

- If fees paid do not cover county’s operating costs, county may increase rates paid by WMI

- WM will pay $2.00/ton to county for recyclable materials

- WMI will pay $1.40/ton quarterly to Clinton Township, the host community

Pop Quiz for commissioners: Explain why the dump is not a financial win for the county. Show all your work.

It’s time to find a private company to operate the facility.

Why?

The site is also in need of renovations, County Administrator Myhre said.

What renovations and how much would they cost? Every operation is a revenue and cost equation. Myhre offers no evidence that a sound cost analysis has been done — or he’s not telling.

The transfer station has an annual operating budget of $194,320, according to the proposed 2023 proposed county budget.

For what? Myhre implies selling the dump would save $194,320, but also claims the only county employee assigned to the dump would be “reassigned,” not terminated, so there’s no savings.

County Administrator Myhre noted the process to arrive at a point where the transfer station could be sold has surpassed a decade.

This is nothing short of embarrassing. What was the process? Myhre has provided no information about any “process” or about how the commissioners came to the conclusion to divest taxpayers of a public asset.

“It has been the desire of this board as Hunterdon County would like to get out of the business altogether of operating that transfer station. Ultimately we believe it is in the best interest of the county,” Myhre said.

Myhre has offered no facts, data, financial analysis or other justifications for what the commissioners “believe,” or why “it is in the best interest of the county.”

Commissioner Director Zachary Rich said, “For many years the county has examined the potential privatization of the transfer station so as to remove governmental bureaucracy for what should be a private business operation.”

Where are the results of the years-long examination? Who conducted it? Where’s the report? Where are the recommendations so taxpayers can see them? Why “should [the dump] be a private business?” Astonishingly, Rich admits to running Hunterdon County as a “governmental bureaucracy.”

“There are substantial infrastructure improvements necessary to continue operations at the transfer station and those costs are better borne by a private investor rather than our county’s taxpayers.”

In making the decision to sell, the commissioners must have calculated the costs of improvements, or how could they judge whether it would be worth the investment for the county? What are those costs? How does selling the dump relieve taxpayers of the costs of improvements? Wouldn’t the commercial buyer just pass the costs on to taxpayers that use the dump, since it would presumably be a profit-making business? To justify shifting the costs to the buyer, the commissioners need to provide a defensible estimate of what it would cost taxpayers to use the dump.

More questions taxpayers deserve answers to before the commissioners vote to sell county dump

- What’s the detailed breakdown of the $194,320 in “the annual operating budget”?

- How much in revenue, fees and other payments did Waste Management deliver to the county last year?

- The Hunterdon Review (6/14/23) reports that former County Administrator Kevin Davis, the only speaker during public comment, said at the June 6 public hearing that “not all county residents see the benefits of the dump.” Where’s the survey or study that supports this claim?

- How many people, businesses and municipalities use the dump?

- What are Waste Management’s monthly and annual revenues from dump operations?

- Did WM really make only $75,500 in annual profit on $4.86M in revenues per the proforma they provide in their contract?

- What’s the detailed explanation for why dump isn’t making money for the county?

- Did the county produce a report that justifies the sale?

Are public questions really welcome?

State law requires the commissioners to hold two public hearings and to wait 90 days after the second hearing to take action on selling the dump. The public has the right to offer comments and ask questions at these hearings.

However, a recent news report raised questions about whether the county would in fact answer questions from the public:

[The county’s] special counsel on the Transfer Station sale process, David Weinstein, a partner in law firm Archer & Greiner P.C. provided information about the hearing. “If people wish to provide questions they can I do so to either the County Counsel or County Administrator so they can (1) be answered and (2) the board can be aware of what those questions are. People can ask questions tonight and though the board is under no obligation to answer and address those questions, you can provide answers just as any questions posed here at a public meeting can be answered.” -Hunterdon Review, 6/14/23

Neither the special counsel’s nor the Administrator’s e-mail addresses seem to be published on the county website.

Submit your questions

“Please accept these questions on the matter of the sale of the county dump. I look forward to your answers prior to the commissioners’ vote on the sale on June 27, otherwise I will not be fully informed to make comments at that meeting. Thank you.” [Be sure to include your name, e-mail and/or street address after listing your questions.]

To keep the commissioners honest, please cc to admin@exmayor.com.

Final public hearing prior to vote by commissioners to sell county dump

The second public hearing is set to occur at 5:30 p.m. on Tuesday, June 27, inside the Clinton Township Public Safety Building at 1370 State Route 31 North in the Annandale section of Clinton Township.

Shame on the Hunterdon County Commissioners and Administrator for not taking it upon themselves to fully disclose details of the dump’s operations, including the financials, prior to making a decision. Taxpayers deserve to know more than “we believe it’s time to sell it!”

Taxpayers deserve a clear, honest, independent, compelling report that justifies — without question — the sale of a significant public asset with revenues close to $5 million. Otherwise, will this smell like a backroom deal to taxpayers?

: :

These are predominantly high-priced market units — up to 80 percent or more of them — that yield windfall profits for their builders. Most of them are brought to you by courts that call them a “builder’s bonus” because they include a tiny number of court-mandated “affordable housing” units — a 4:1 ratio. Most of these developments pay no normal property taxes.

These are predominantly high-priced market units — up to 80 percent or more of them — that yield windfall profits for their builders. Most of them are brought to you by courts that call them a “builder’s bonus” because they include a tiny number of court-mandated “affordable housing” units — a 4:1 ratio. Most of these developments pay no normal property taxes. The Council’s full name is the

The Council’s full name is the  In

In  Do you use the county dump, a.k.a. the

Do you use the county dump, a.k.a. the  Like the Clinton Township Community Coalition (CTCC) did in Clinton Township during the Windy Acres planning board approval process (

Like the Clinton Township Community Coalition (CTCC) did in Clinton Township during the Windy Acres planning board approval process ( Yesterday morning the N.J. Water Supply Authority reopened Route 629 over Round Valley Reservoir following months of public outcry. A caravan of 20 vehicles took a drive over the road late in the afternoon, celebrating the success of local activists intent on reopening the road.

Yesterday morning the N.J. Water Supply Authority reopened Route 629 over Round Valley Reservoir following months of public outcry. A caravan of 20 vehicles took a drive over the road late in the afternoon, celebrating the success of local activists intent on reopening the road.

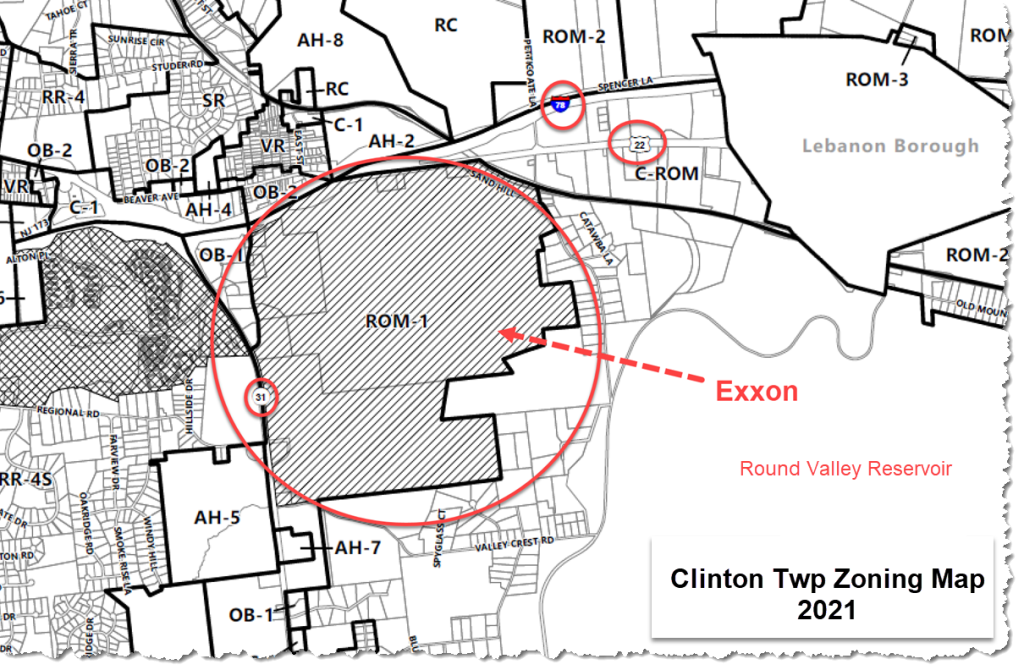

Or, Exxon could offer to improve “prevailing traffic problems,” as it did in its letter. But the clever letter makes no mention of dealing with the future traffic problems that potentially thousands of truck trips per day would be generated by a 4 million square foot warehouse. (See

Or, Exxon could offer to improve “prevailing traffic problems,” as it did in its letter. But the clever letter makes no mention of dealing with the future traffic problems that potentially thousands of truck trips per day would be generated by a 4 million square foot warehouse. (See  An elected official’s obligation to their citizens is to apply the law. Not to make deals — or sausage.

An elected official’s obligation to their citizens is to apply the law. Not to make deals — or sausage.

Today

Today