Clinton Township raised its municipal property tax rate dramatically compared to a host of other neighboring towns this year, but the Council tried to gloss over it at the May 8, 2019 public hearing on the budget.

Clinton Township raised its municipal property tax rate dramatically compared to a host of other neighboring towns this year, but the Council tried to gloss over it at the May 8, 2019 public hearing on the budget.

And Mayor John Higgins snapped when an ExMayor exposed the stunning increase.

(Source: Clinton Township official recording, May 5, 2019 council meeting.)

New Jersey law guarantees the right of citizens to make comments at public government meetings without interference by a governing body. During a budget hearing, N.J. has a statutory requirement that the public be heard before a public budget is adopted.

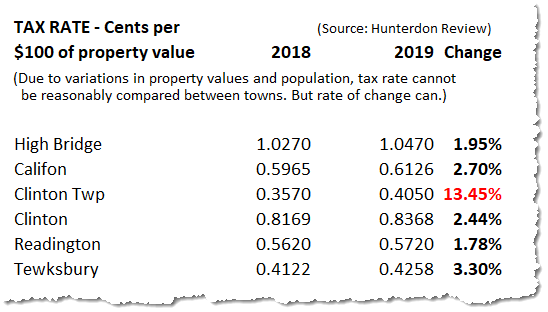

13.45% increase in Clinton Township municipal tax rate

The boost in the municipal tax rate Clinton Township residents will be paying is 7 times higher than the increase in Readington Township.

This year, Readington increased its tax rate just 1.78% compared to Clinton Township’s 13.45% increase. Readington is the nearby town most similar to Clinton Township.

The next highest tax rate boost is in Tewksbury: 3.30%. Clinton Township’s increase is 4X higher than that. No town in the list below is even close to Clinton Township’s boost.

(The tax rate is cents per $100 of your property value.)

Because tax rates are based on a town’s population, budget and property values, it is not reasonable to compare tax rates across towns. (As can be seen, tiny High Bridge has an enormous tax rate, while enormous Readington’s is about half that, while tony Tewksbury’s is lower than both.) However, the percentage of change in tax rates is a legitimate comparative metric of how municipal governments manage their finances. (Source of data: Hunterdon Review.)

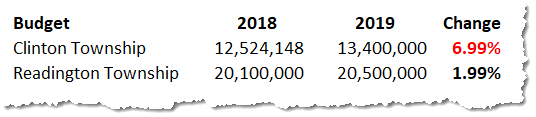

A massive boost in the budget

Clinton Township’s municipal budget is up 6.99% for 2019, from $12,524,148 to $13,400,000 — almost a million bucks.

Readington’s budget is up 1.99%.

Who funds the budget increase?

Part of a town’s budget is funded by revenue sources including State aid and fees collected by the municipality. Taxpayers pay the rest.

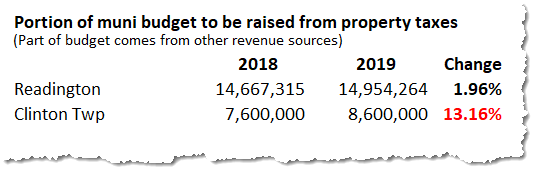

Readington’s taxpayers are paying just $286,949 of its budget increase.

Clinton Township’s taxpayers are paying $1,000,000 of its budget increase.

Readington’s revenue from property taxes will go up just 1.96% in 2019.

Clinton Township’s taxpayers will contribute 13.16% more to the town’s budget than last year.

Where’s all that money in Clinton Township going?

We’ll tell you in the next edition where taxpayers’ money seems to be going.

: :

To get update notices via e-mail for new articles on ExMayor.com, click here to subscribe. Use the option indicated below.